Published: February 2019

By Dr. Radziah Mahmud and Rosmini Mohd Aripin

An integrated reporting is a benchmarking free business report which is intended mainly for private sectors. However, it could be adapted for other reporting entities. This report highlights the organisation’s policy, governance, performance and prospects, which eventually increase business value over time.

The existing financial reporting model which focuses mainly on past financial performance of entities is insufficient because it is meant for compliance purposes and is seen to be losing its relevance (Bhasin, 2017). Thus, we argue that the current reporting model should be revised due to the evolution in the business environment and business model. Even though increased magnitude of disclosed information is observed through more lengthy published reports, the disclosure gaps between the stakeholders’ and information supplied by the report preparer’s remain.

In order to overcome the limitations of traditional corporate reporting, a report that provides a broader explanation of firm performance integrating relevant financial and non-financial information is proposed by the International Integrated Reporting Council (IIRC). This type of report is essential to provide an extensive evaluation of the continuing feasibility of the reporting entity’s business model and strategy and its ability to meet the expectation of investors and other stakeholders, which will potentially lead to a more effective distribution of limited financial resources (IIRC, 2013). In short, an integrated report provides concise information on how an entity’s policy, governance, performance and prospects, result in value creation over the short, medium and long term (IIRC, 2013).

Integrated reporting is intended to enhance the quality of information accessible to the potential and existing investors, lenders and creditors. It also stimulates a more consistent and professional approach to corporate reporting that takes into account various reporting components and discloses factors that materially affect the ability of an entity to create value. By incorporating a wide-ranging base of capitals, integrated reporting should arguably improve the entity’s responsibility and stewardship for those capitals. Integrated reporting highlights integrated thinking, decision-making and procedures that emphasize on value creation over time.

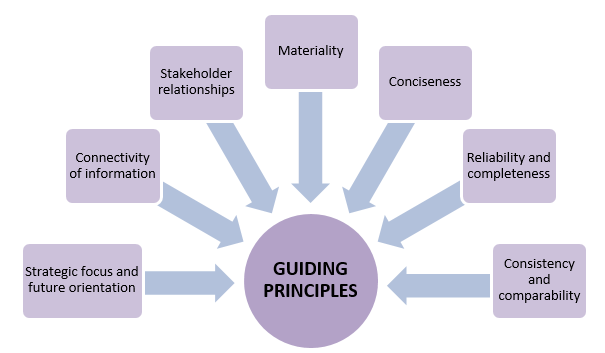

In relation to the content of an integrated report, the International Integrated Reporting Framework (the Framework) has been issued by IIRC in 2013 as a guidance to the preparers of the report. The Framework provides the Guiding Principles that stipulate the organization of an integrated report as shown in Figure 1 below.

Figure 1: Guiding Principles in the Preparation of Integrated Report (IIRC, 2013)

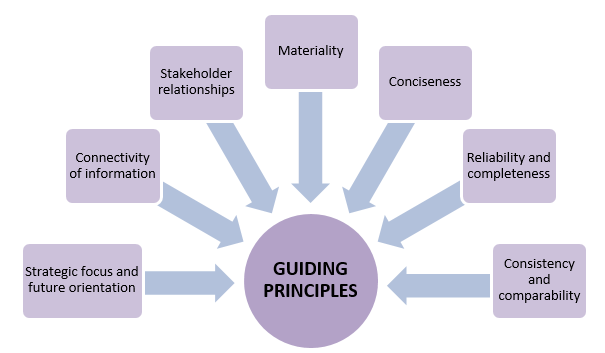

The integrated report should incorporate eight elements that are interdependent of each other as presented in Figure 2 below.

Figure 2: Content Elements of Integrated Report (IIRC, 2013)

The Association of Chartered Certified Accountants (ACCA) (ACCA, 2017) has highlighted the benefits experienced by integrated report adopters. Such report will encourage more efficient reporting through integrated thinking and management; provide greater clarity on business issues and performance; improve corporate reputation and stakeholders’ relationships; greater employee engagement; and improve the profitability of the firms even though the financial benefits of adopting this report may only be realized in future.

While publishing integrated report is mandatory for public listed companies in South Africa, the report is still prepared on a voluntary basis in other parts of the world including Malaysia (Bhasin, 2017; Abdullah, Mat Husin, Mohamad Salleh & Alrazi, 2018). Even though the Malaysian regulatory bodies such as Bursa Malaysia, Malaysian Institute of Accountants and Securities Commission of Malaysia continue their efforts in encouraging Malaysian listed firms to adopt integrated report, the adoption of such report is still in its infancy stage (Abdullah et. al, 2018). This could be due to practical challenges encountered by Malaysian firms. As emphasized by ACCA (2017), the key challenges faced by integrated report adopters are failure to link the content elements to value creation; lack of connectivity of information; difficulty in applying the materiality concept in non-financial information and different reporting framework; complexity in providing concise information related to the firm’s value-creation process and performance; challenges in ensuring that a balance of positive and negative information is equally measured; and complication in assessing the consistency and comparability of information in the integrated report.

Integrated reporting is intended to encourage more sustainable investment and management by promoting firms to provide explanation on how their value is created in a broader sense. Despite the anticipated benefits associated with the adoption of integrated report, its implementation may be deterred due to barriers encountered by the management in producing a high quality integrated report.

Abdullah, N. W., Mat Husin, N., Mohamad Salleh, S. & Alrazi, B. (2018). Integrated Reporting: A Comparison between Malaysian and Singapore Public Listed Companies. 8th International Economics and Business Management Conference.

Bhasin, M. (2017). Integrated Reporting: The Future Corporate Reporting. International Journal of Management and Social Sciences Research,6(2), 19-31.

International Integrated Reporting Council - IIRC (2013). The International Integrated Reporting Framework. International Integrated Reporting Committee (IIRC), London.

The Association of Chartered Certified Accountants - ACCA (2017). Insights into Integrated Reporting – Challenges and Best Practice Responses. Association of Chartered Certified Accountants, UK.