November 19th, 2018

By Professor Dr. Rozainun Haji Abdul Aziz and Associate Professor Dr. Indra Devi Kandasamy

INTRODUCTION

The intention of having a risk management system is to provide for readiness and plans to act upon any potential losses in a practical manner. Businesses, organizations, profit and non-profit entities, including individuals face a profusion of risks every day. Over the years, our risks increase geometrically due to modernization and development from history.

RISKS

Risks existed since the era of Adam and Eve. The ancient times faced losses that have driven people to cope with those losses, be more vigilant and move on afterwards, by taking lessons from experiences. In addition, they learn to manage their conditions over time and improve their standard of living. It is also said that the way we manage risks is identical with that of the animals. Three elements that can be identified that are crucial within managing risk are protection, which is key, followed by detection that comes from experience and response, regarded as a culture and result of an attitude.

Risk has no one definition. However, risk can be seen as a potential loss, danger, and threat and seen to have two outcomes, either loss or no loss. This means that one of the outcomes of risk is undesirable. Scary isn't it? But the possibility is there. However, it is with the knowledge of basic risk management that one may be able to address his/her own risks in a better way so that the outcome will be more acceptable in a hindsight.

CONCEPTUALISING RISK MANAGEMENT

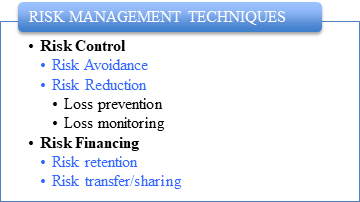

Figure 1 shows Risk Management Techniques, where the important elements within the system are delineated as below:

Figure 1 - Risk Management Techniques (Inspired by Vaughan 1997 and Vaughan & Vaughan, 2014)

It can be seen from the above that there are two categories of Risk Management Techniques, namely Risk Control and Risk Financing.

Within Risk Control, one may choose to avoid the risk of say 'failing the exams' by not registering for a particular course. However, avoiding is regarded as a last resort as taking up any one activity or project would involve risks, without which, how do we progress in life? Risk Reduction attempts to mitigate in order to control and suppress losses from coming to being. Risk can be reduced by preventing and monitoring losses so that all is not lost.

As for Risk Financing, one may opt for retention as in making provisions and charging to the Profit and Loss Account for foreseeable losses, for example, bad debts, and notional charges. In addition, Transfer or Sharing means an individual or an organization buys insurance, hence transferring its risk to the insurance company for protection. As such, compensation will be paid for damages incurred.

PERILS AND HAZARDS

Risk co-exists with perils and hazards. Risk, if not controlled will turn into losses. Perils are the cause of losses, whilst hazard is the condition that gives rise to and increases the chance of losses.

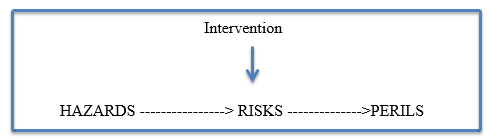

Figure 2 Risk Intervention of Hazards to Peril

It can be seen from Figure 2 that hazards will raise awareness to recognize the risk that if not managed, will lead to perils or losses. Such intervention calls for dedication to a better understanding of risk so that one can manage accordingly.

There are four categories of hazards as below (Vaughan, 1997/2014):

- Physical – for example, the peril of fire due to the low grade of materials used in constructing the building.

- Moral/criminal – for example, a dishonest person claims more than entitlement.

- Morale – careless attitude, for example, leave car keys that increase the possibility of car theft.

- Legal hazard – arising from court decision and statutory liability with lack of evidence resulting to, say, fraudsters on the loose.

It is at the point of intervention where risks can be mitigated by controlling the hazards before slipping into perils, whether intentionally or unintentionally.

MANKIND

As indicated earlier, attitude is a human feature that builds culture towards behavior and responding to a risk. If the attitude is negative, then further action will be negatively orientated and thereafter will be resulted in a negative way. If positive, the thought and perseverance will produce a better outcome.

CONFLICT OR CONCUR?

The 'want' of anyone is desirable but it might be at a risk, as the saying goes 'you win some, you lose some'. Taking risks depends on whether one is a risk taker, risk averse or risk neutral. Nevertheless, risk is by far undesirable, in general terms, for fear of the unexpected negative outcome. However, the positive returns are definitely the result of good managing of risks. So how much are we willing to accept risk? The answer is in one's capability that will drive the level of acceptance and determine one's choice towards taking risk. it is in the attitude of people that belief will coin into behavior and reaction to hazards. More often than not, the preference to a gain or no loss, that only the person can judge whether it is worth taking the risk.

DOMINOES THEORY

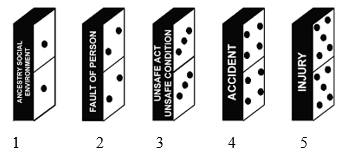

Whether there is a conflict or a concur between risk and mankind, the question lies in a situation where Vaughan (1997) explained from the viewpoint of Heinrich Domino Theory, as depicted in Figure 3 below.

Figure 3 - Heinrich Domino Theory

(Source: actassociates.org.uk; accessed on 15 October 2018)

Figure 3 above shows five pieces of dominoes comprising of the (1) environment, (2) fault of persons, (3) unsafe act, (4) accident and (5) injury. Moving from right to left of the diagram above, usually, when a loss is detected, say an injury has been suffered, it is trailed back to the reason for the injury, in this case, an accident has occurred. Then, the reason for the accident is investigated which could be due to an unsafe act or an unsafe condition, normally established as a hazard. This then gives a lead to who is accountable for the fault of persons, where the act and condition exist. Checks on the logistics, capabilities, and policies including SOPs (Standard of Operating Procedures) will take place which then returns to the social environment that routes into culture and attitude as well as a way of life. This whole scenario stems from the environment in which we have been brought up and our upbringing decides culture and attitude that we develop over time and experience, with the level of knowledge we collect along the way. If the orientation is positive and forward-looking, the 'players' in the environment will follow the norms. The impact then that follows will influence the persons carrying the tasks, that might or might not create hazards before an accident might occur to the injury that could be suffered. If the first three pieces of dominoes are controlled and managed properly, an accident can be avoided and injury is saved from.

CONCLUSION

It is to the best of a person's ability and capability that risks can be managed effectively. Understanding the meaning of risk will bring us a better level to mitigating potential losses. Hence, Figures 1, 2 and 3 given earlier will provide a good yet concise background for us to be more prepared, if and when faced with any risk.

It is hoped that this paper has given better insights into what is risk, what is mankind, and how they inter-relate in a question of whether a conflict or a concur through the rationalization of Dominoes Theory, as a basic foundation to addressing risks and losses. It should be noted that addressing the current situation, with respect to controlling hazards, might mean improvising the theory taking into account all peculiar demands and prevailing factors alike.

Vaughan, E.J. (1997). Risk Management and Insurance. Wiley. The USA.

Vaughan, E.J. and T.M. Vaughan (2014). Fundamentals of Risk and Insurance. 11e. Wiley. The USA.